Empirical Credit risk management(ECM)

Empirical Credit Risk Management (ECM) is an exciting new methodology and software product developed by the banking consultancy, Finalysis Ltd, designed to locate, measure and manage credit risk in Instalment Finance.

Traditionally, loss forecasting in instalment finance has been more of an art and less of an exact science. Correct provisioning has, in consequence, been difficult for banks to achieve – certainly to the satisfaction of either bank auditors or Revenue.

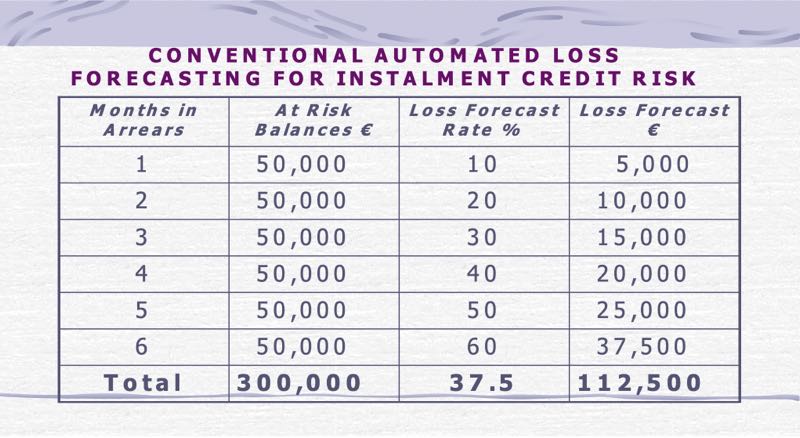

ECM is a mathematically constructed, actuarially certified system for tracking: default and loan losses, the ages, maturities and compositions of loan portfolios and arrear movements – and then developing a macro loss forecast and provisioning requirement. In table 1, below, we illustrate the conventional approach and follow, in table 2, with the alternative ECM approach.

Table 1:

illustrates the normal automated approach to loss forecasting and to loan provisioning.

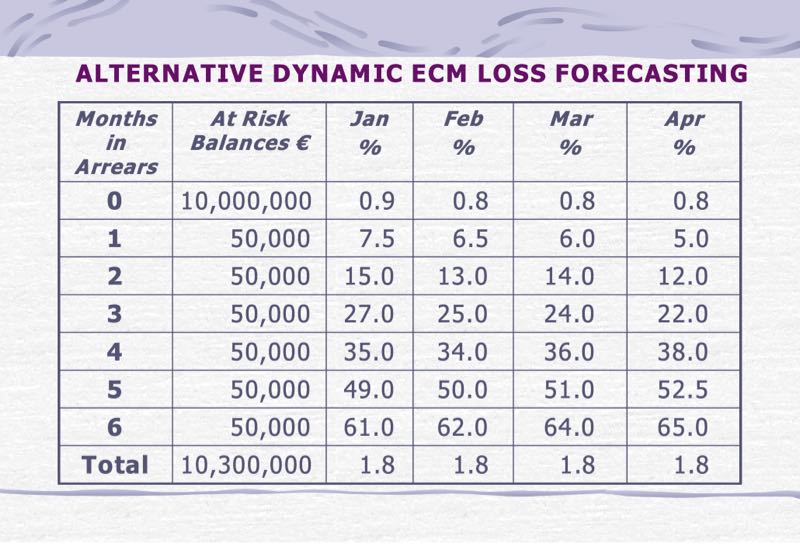

The ECM Approach

In the following, alternative ECM approach, the variability of risk over time is recognised, also the presence of risk in non delinquent accounts.

Table 2:

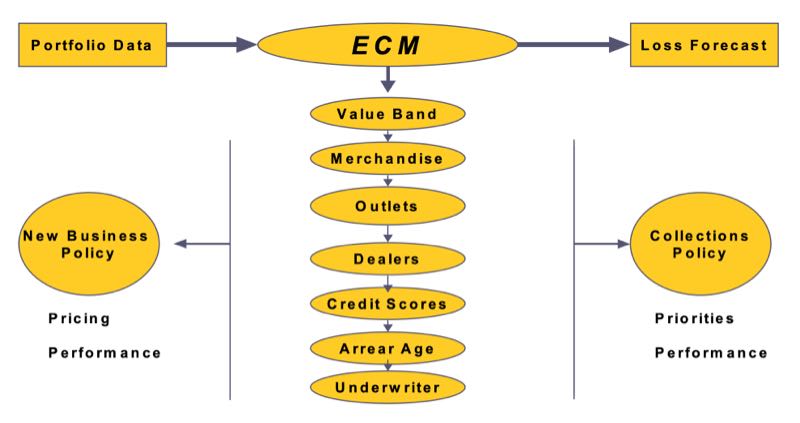

1: Subsidiary Level Risk Analysis

The first requirement for correct subsidiary analysis has to be correct calculation at the Macro level, as

ECM does. Using data mining techniques, and characteristic analysis, this macro loss forecast is then

distributed, via ‘risk coefficients’ across relevant loan characteristics – eg Dealer Sources, Merchandise

Types, Credit Score Bands, Loan Maturities, etc, producing the subsidiary risk analysis also required for

Basel II compliance – we illustrate.

Subsidiary analysis – ECM Software Dynamics

2: Finally – Loss Forecasting by Account

Further cross referencing and weighting of relevant characteristic risk coefficients makes it possible to distribute this subsidiary risk measurement across the individual loans, providing loss forecasts and specific provisions at the level of individual loans, again including the non delinquent accounts.

ECM Delivers Tax Benefits

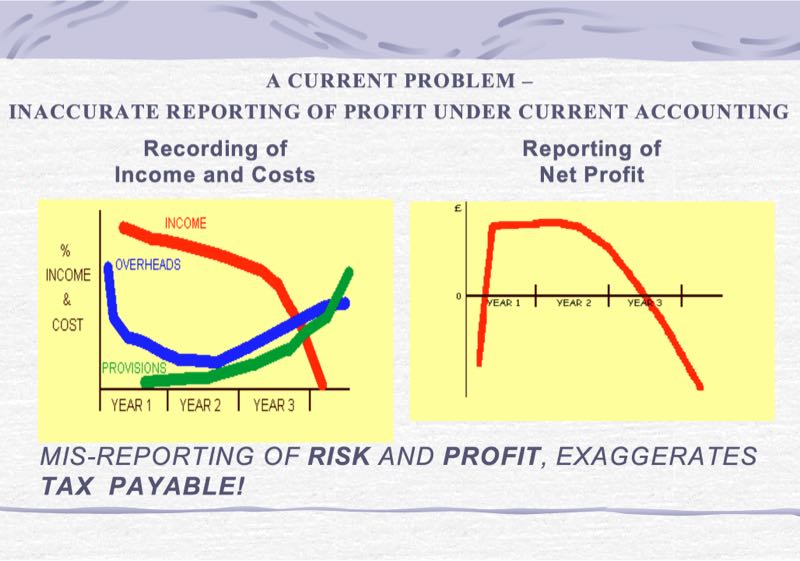

ECM based risk calculations and specific provisions are recognised by Revenue, on the basis that they synchronise risk recognition with income recognition, as measured under the Rule of 78.

Under the traditional approach to loss forecasting and provisioning, risk recognition has seriously lagged the recognition of income, thereby creating a front-end ‘profit illusion’, also resulting in the premature payment of tax, as illustrated below.

Below, we illustrate the potential benefit of being able, through the use of ECM, to convert former general provisions, into specific provisions.

The Current Status of ECM

ECM has achieved actuarial and academic recognition (a PhD in Risk Management for its developer). It has been validated by bank auditors and has been submitted for review by two bank regulators. The ECM methodology has been successfully deployed by five leading Irish banks and the software is now being installed in two banks.

Benefits available under ECM include:

- Reduced default, via an ‘early alert’ on high-risk accounts.

- Improved New Business quality, through identification of risk sources.

- Improved Collections, through the precise ranking of at risk balances.

- Strategic pricing opportunities for high and lower risk business.

- Basel II compliance, through subsidiary risk analysis.

- Substantial tax benefits, through precise identification of individual specific provisions.

- Development of League Tables and Performance Management for Dealers, Underwriters, Collection Managers, Merchandise Types etc (under ECM Collections, becomes a Profit Centre).

ECM Software

The ECM software has been designed to interface easily with most Instalment Finance databases, where static and dynamic data recorded by banks are broadly uniform. In its simplest form, ECM can be used simply to calculate the loss forecast and the specific provisions appropriate at any point in time (and, indeed, over time). ECM can, secondly, be used to develop risk coefficients for all loan characteristics, especially for Basel II purposes. Finally, the product may be used to develop specific provisions for all loans and to develop League and Performance Tables for all loan types and loan characteristics – important management information.

The ECM methodology and software, which have been in development for some years, carry two patents. The product is now being marketed to banks in the UK and in the US.