Risk Management in Instalment Credit.

Banking Ireland, Winter 1994.

Patrick Shallow – Managing Director, Finalysis Ltd.

Consumer Credit

While the risk of default is a major concern in all types of credit, for consumer credit bad debts is the largest and most volatile overhead. The bad debt experience of lenders varies very considerably, depending on the financial product used, the lender’s market strategy, the regional location etc. While the industry ‘norm’ is broadly reported at 4% of initial advances, the experience of some lenders can at times rise to over 8%. The critical importance for management of having good information, facilitating early detection of problems and appropriate collection procedures is well recognised. Yet, the continuing lack of a consistent accounting approach to risk measurement would suggest that credit management survives largely as the art of the lender, rather than having become a statistical science. To some extent this may reflect the difficulty that financial accounting has in forming one year views on a transaction which stubbornly, has a three (or five) year time frame.

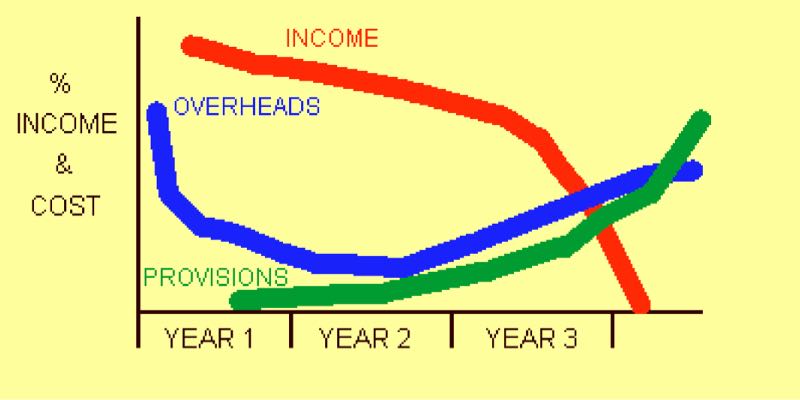

Below we graph ( graph 1 ) the management information produced by the conventional accounting approach to the three year life cycle of an instalment loan portfolio. (For our graph we assume a certain level of overheads – marketing underwriting etc. – before the loans are advanced in, say, April of year one).

Graph 1: Typical Income, Cost and Profit in a Three Year Loan Portfolio

Features to be noted from the graph include:

- The ‘front loading’ of income, based on the actuarial or ‘rule of 78’ principle of income recognition (itself a debatable procedure)

- The initial (pre-advances) high level of overheads, reducing later in year one, followed in turn by a ‘pick up’ from year two onward, associated with the emergence of arrears and collection activities.

- The gradual impact of bad debt provisioning costs, again reflecting emerging arrears. (Observations indicate that arrears first emerge, on average, after 8 months and that they peak in the 15 to 21 months period after inception).

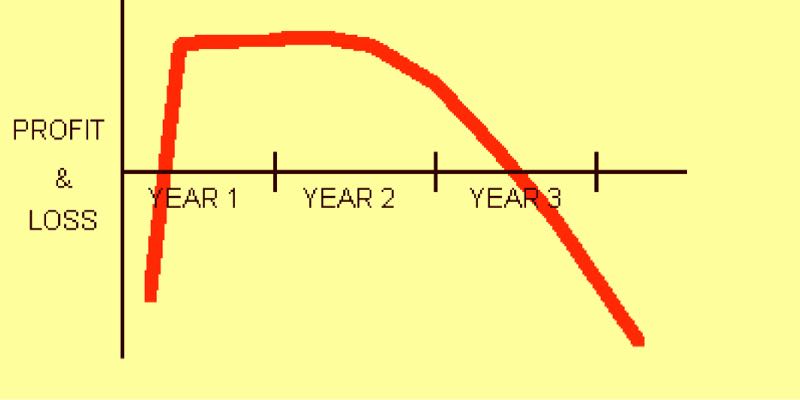

We show below ( graph 2 ) the resulting pattern of profit recognition over the three years.

Business in the first year is represented unfairly, as being especially profitable, with subsequent years appearing, again unfairly, as being somewhat unprofitable. An important consequence is that, while loans are growing rapidly with outstandings having an average maturity of less than one year, this ‘profit illusion’ continues. When growth, thereafter, slows or contracts there can be a concern at the sudden loss of profitability. (This phenomenon has been experienced by a number of Irish Finance Houses over the years).

The above simplified analysis clearly argues for a more realistic and pragmatic approach to financial accounting. The element most in need of such reviews is perhaps, debt provisioning.

Provisioning for Bad Debts.

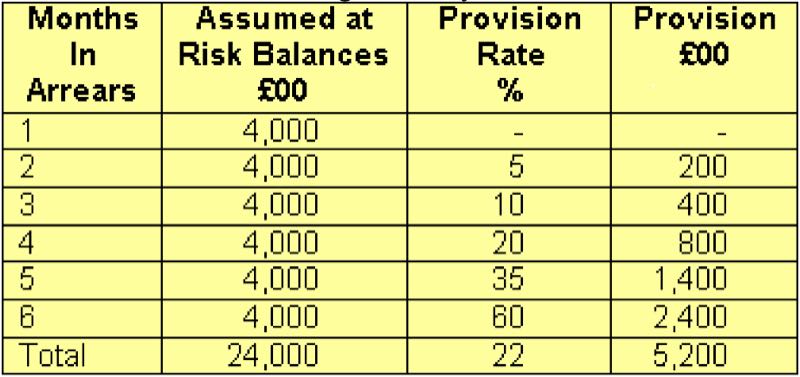

One of the many approaches to debt provisioning is shown in table 1.

This, or some similar approach is used widely, contributing to the distorted distribution of profits, already discussed. From the management perspective, this approach can be unhelpful and is potentially misleading e.g.:

- Individual provision rates, which are arbitrarily set, make no attempt at accuracy, by reference to experience.

- Rates fail to differentiate between regions, markets or branches – where risk profiles can be very different.

- Rates are insensitive to changes in the economy and market conditions, failing to adjust over time.

These criticisms would be of little relevance if the anomalies were confined to the arcane field of financial reporting. But the figures do have real consequences.

- Incorrect and inadequate provision rates exaggerate the profitability of new business as shown, and thereby misdirect the allocation, between new business and collections, of staff and other resources.

- Badly structured provision rates can undervalue the entire collections effort and also misdirect energies between ‘front end’ and ‘back end’ arrears.

- Most importantly, delayed recognition of higher risk leads to avoidable defaults.

Table 1: Conventional Approach to Risk-Recognition and Debt Provisioning

Based on an Aged Analysis of Arrears

The principal objective of financial accounting should, arguably, be directed at informing and directing general and local management, rather than simply posting historic results.

Risk Management and Credit Scoring.

Contributing to the above difficulty of measuring total risk is the conventional perception that all risk attaches to the borrower – bringing with it an implicit reliance by management on credit scoring. What is too easily forgotten is the significance of the ‘external’ variables:

- Economic conditions, tax changes, unemployment and interest levels – all of which have a clear bearing on the borrowers’ ability to repay.

- The availability and the use by the lender of credit information.

- The purpose of the loan, the quality of the merchandise involved, the integrity of the referral source.

- The efficiency of the lender’s own procedures, whether in new business administration, in collection or legal enforcement.

The significance of all these features needs to be recognised together with the credit score for the complete and accurate evaluation of risk. One should, in addition, allow for the time profile of such risk. The fact that arrears first emerge some eight months after inception should not lead to deferring making any provision for what, on the basis of experience and probability, is a measurable risk.

Conclusion

The purpose of this article has been to identify some problems for the management of risk associated with current accounting conventions. It is not proposed here to attempt a detailed description of an empirically-based alternative. However, it is worth noting that, when risk is measured accurately and continuously it can, via accurate provisioning:

- Prioritise accounts for collection, thereby informing and directing the entire collections function.

- Measure performance unambiguously at all levels, product, branch, new business, collections and referral sources.

- Assist in the strategic pricing of products.

- Review and ‘retune’ credit scores, down to the regional level.

The relevant mathematical principles and procedures are available, and are already used for the measurement of risk in life and general insurance. Current technology can now handle the monthly calculations involved. The need for and relevance of such an approach has been the subject of this article.

If you are interested in any Finalysis services or products, or in discussing commercial associations or franchise arrangements, why not Contact Us now?